Nikkei falls nearly 2. China debt crunch China Evergrande crisis rocks markets across globe.

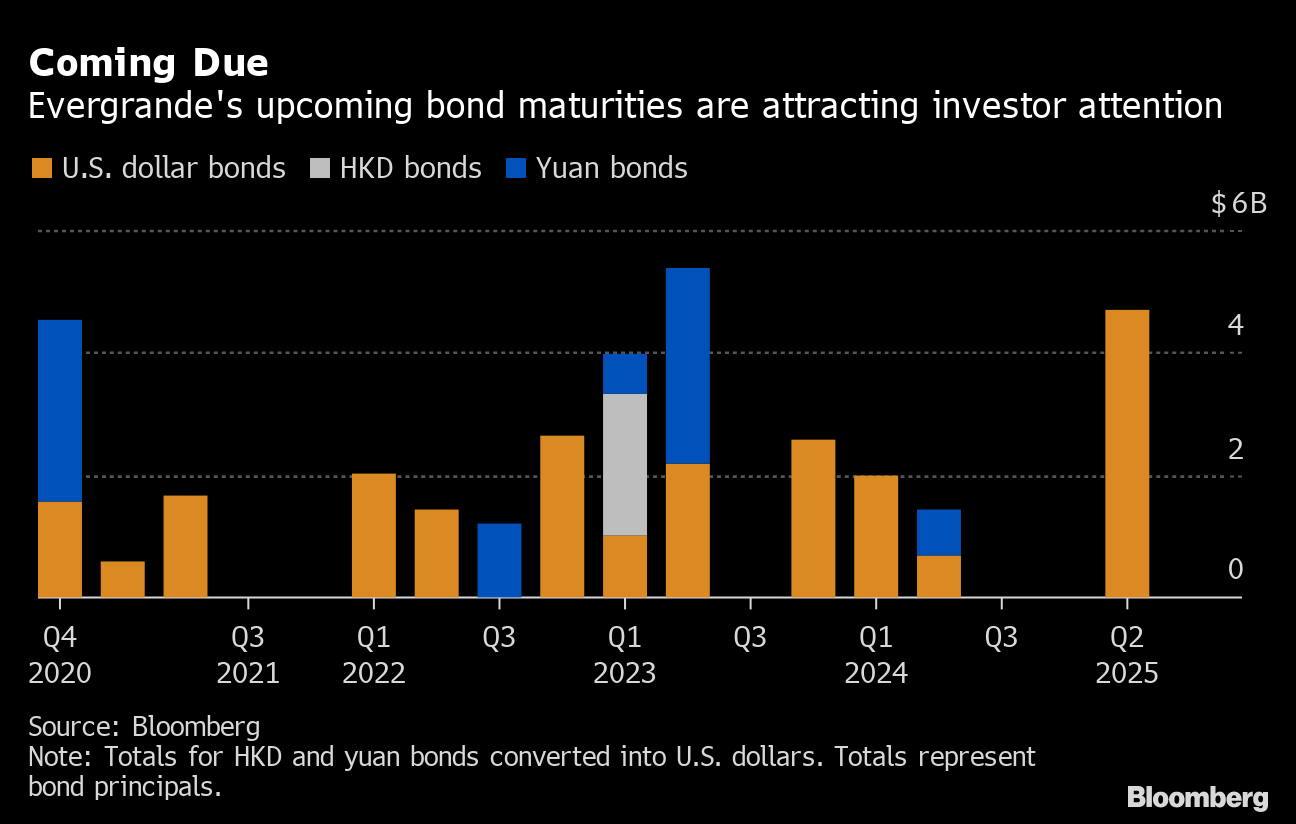

Evergrande is faced with more than 300 billion in debt hundreds of unfinished residential buildings and angry suppliers who have shut down construction sites.

Evergrande debt crisis. As China Evergrandes debt crisis deepens unpaid small business owners speak of despair. Property giant China Evergrande Group has said that it cannot sell properties and other assets fast enough to service its massive 300bn debts and that its cashflow was under tremendous. The way Evergrande grew so.

A trader works at the New York Stock Exchange. Dont Let Your Money Worries Get You Down. Evergrandes debt crisis is continuing to unsettle investors in Asia and raising concerns about whether a potential default by the troubled Chinese conglomerate could spill over to other parts of.

Evergrande now the worlds most indebted real estate company is on the brink of collapse and the news sent global markets tumbling. T he crisis engulfing Evergrande Chinas second-biggest property company is the greatest test yet of President Xi Jinpings effort to reform the debt. The biggest fear investors should have with the crisis gripping overly indebted Chinese real estate developer Evergrande is global contagion.

Speak to Our Expert Debt Consultants Today. Evergrande achieves one of the debt ratio caps set by regulators by cutting its interest-bearing indebtedness to around 570 billion yuan from 7165 billion yuan six months ago. Ad Freeze Interest Charges Write Off Unaffordable Debts Start to Become Debt Free.

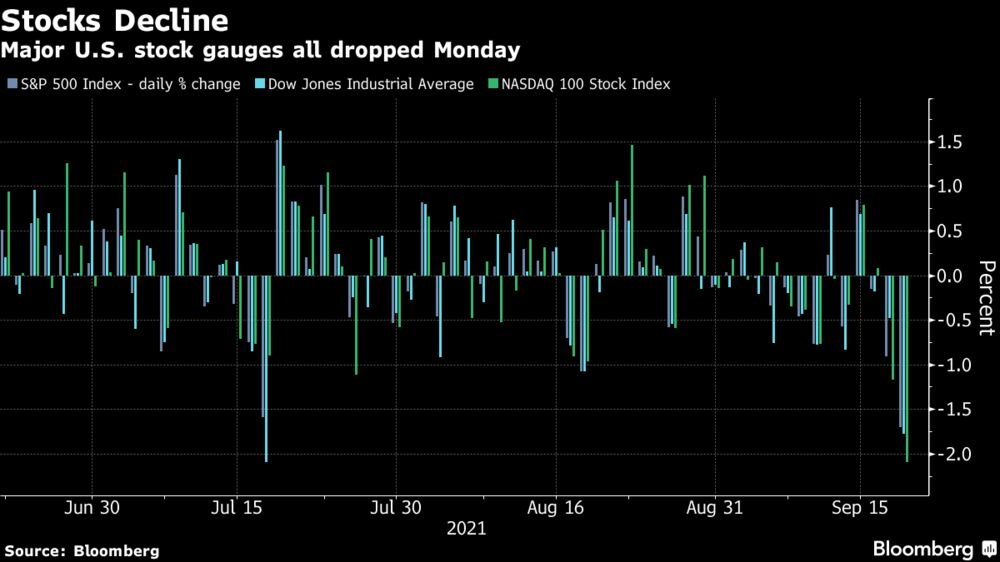

Alice Charles and Kalin Bracken 21 Sep 2021. A man wearing a protective face mask walks past a stock quotation board outside a. Evergrandes debt crisis has jolted the stock market.

Snowed under its crushing debt of 300 billion Evergrande is so huge that the fallout from any failure could hurt not just Chinas economy. People gather to demand repayment of loans and financial products as. Ad Freeze Interest Charges Write Off Unaffordable Debts Start to Become Debt Free.

What is the Evergrande debt crisis and why does it matter for the global economy. Dow sheds 600 points in worst day since July. Contagion could spread to markets beyond China.

Dont Let Your Money Worries Get You Down. China Evergrande has committed two cardinal sins which have led to the debt crisis its now facing and investors are definitely sweating according to one portfolio manager. Evergrandes problems began last year when Beijing clamped down on the amount of debt that big real-estate developers can owe.

Heres why everyones suddenly worrying about Chinas 2nd-largest property developer. Evergrande the worlds most indebted property developer is crumbling under the weight of more than 300 billion of debt and warned more than once it could default. World shares jolted by Evergrande crisis as debt payment test looms FILE PHOTO.

Speak to Our Expert Debt Consultants Today.

China S Debt Surge May Increase Risk Of Financial Crisis Debt Crisis Financial

How China Evergrande Landed In Crisis Mode Again A Timeline In 2021 Debt Problem Equity Ratio Financial Stability

Evergrande Faces Crisis Of Confidence Over 120 Billion Debt Bloomberg