A debt crunch involving Chinas second largest properly developer has caught investors attention in the past week. Evergrande has the potential to be the largest corporate debt default ever with spillovers to other financial institutions Evergrandes suppliers homeowners wealth product holders other.

Chinas Evergrandes shares pummelled on fear of debt default.

Evergrande debt default. Chinese property giant Evergrande warns again that it could default on its enormous debts In some ways the companys aggressive ambitions are what landed it in hot water according to experts. Contagion could spread to markets beyond China. Evergrande the Shenzhen-based company is facing a default on its debt burden.

And concerns are mounting that if it defaults on its debt it could spell disaster for Chinas property market and send. Rating agency SP on Wednesday further downgraded Evergrande to CC from CCC with a negative outlook citing reduced liquidity and default risks including the possibility of debt restructuring. China debt crunch Chinas souring developer loans raise fear of financial contagion.

And considerations are mounting that if it defaults on its debt it would spell crisis for Chinas belongings marketplace and ship surprise waves throughout the internationals second-biggest financial system. Debt troubles at the property group have been dragging down global markets as investors assess the implications of a credit default. China Evergrande Staff is deeply within the purple to the track of 300bn.

Snowed under its crushing debt of 300 billion Evergrande is so huge that the fallout from any failure could hurt not just Chinas economy. The firm reiterated it could default on its debt repeating a warning it issued two weeks ago. China Evergrande Group is unlikely to receive direct government support and is on the brink of defaulting on upcoming debt payments SP Global Ratings said.

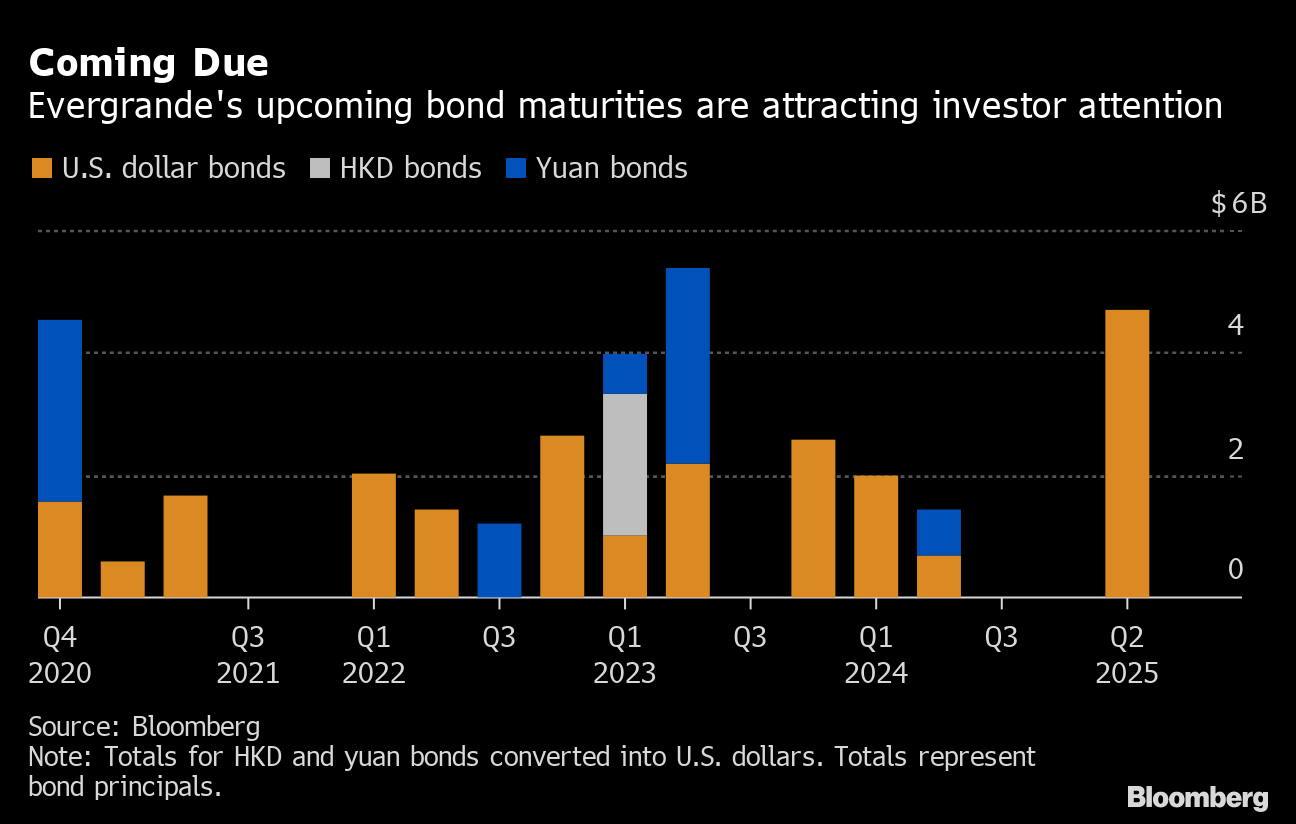

In the debt market Evergrandes June 2025 dollar bonds fell nearly 6 cents on Tuesday late morning to 27 cents yielding 5845 according to financial data provider Duration Finance. Evergrandes debt crisis is continuing to unsettle investors in Asia and raising concerns about whether a potential default by the troubled Chinese conglomerate could spill over to other parts of. Evergrande Is Likely to Default Without Direct Support SP Says.

China Evergrande Group is deeply in the red to the tune of 300bn. Evergrandes looming default is spooking markets but three top analysts say this isnt Chinas Lehman Brothers moment Harry Robertson Sep. As Evergrande scrambles to raise funds to pay off debt regulators warn of broader risks to Chinas financial system.

China debt crunch China Evergrande warns of default risk if it fails to sell assets. 20 2021 0845 AM. Evergrande has been trying to sell some assets to ease its liquidity crunch but said those efforts.

A reckoning gave the impression even nearer on Wednesday after Bloomberg Information bringing up other people accustomed. Bloomberg -- China Evergrande Group is unlikely to receive direct government support and is on the brink of defaulting on upcoming debt payments SP Global Ratings said. In any default scenario Evergrande teetering between a messy meltdown a managed collapse or the less likely prospect of a bailout by Beijing will need to restructure the bonds but analysts.

Shares in the embattled Chinese property giant Evergrande have slumped again after two credit downgrades in as many days amid concerns that it will default on parts of its massive 300bn debt pile. Evergrande is struggling to raise funds it needs to pay its.

Evergrande Faces Crisis Of Confidence Over 120 Billion Debt Bloomberg

Evergrande How China Evergrande S Debt Troubles Pose A Systemic Risk Real Estate News Et Realestate