Daniel September 19 2021 add comment Amid hypothesis as to whether or not Chinas second-largest property developer Evergrande Group will default on its 300 billion in money owed analysts are questioning whether or not the agencys collapse might pose contagion dangers for the crypto trade. Are You 5000 Or More In Debt.

Ad Pay Back As Little As 60 Per Month UK Debt Relief Scheme.

Evergrande debt holders. In addition to that debt Evergrande holds 74 billion in bonds that are due in 2022. While Chinas offshore CDS market is illiquid and rarely used holders of Evergrandes debt are global and not being able to hedge for the downside is unusual. Last modified on Mon 20 Sep 2021 0106 EDT.

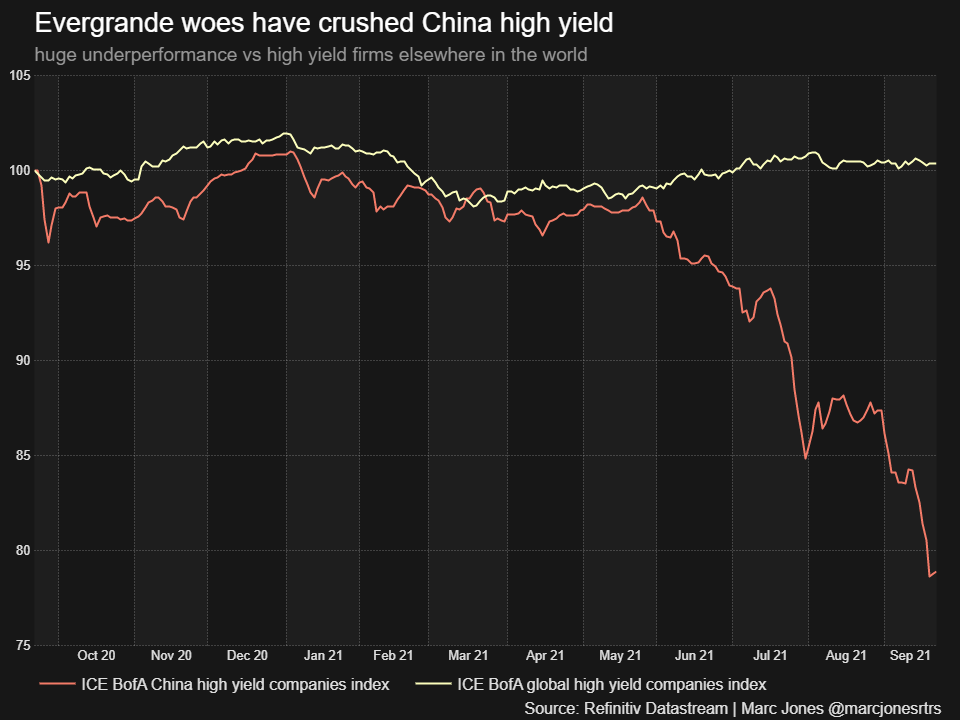

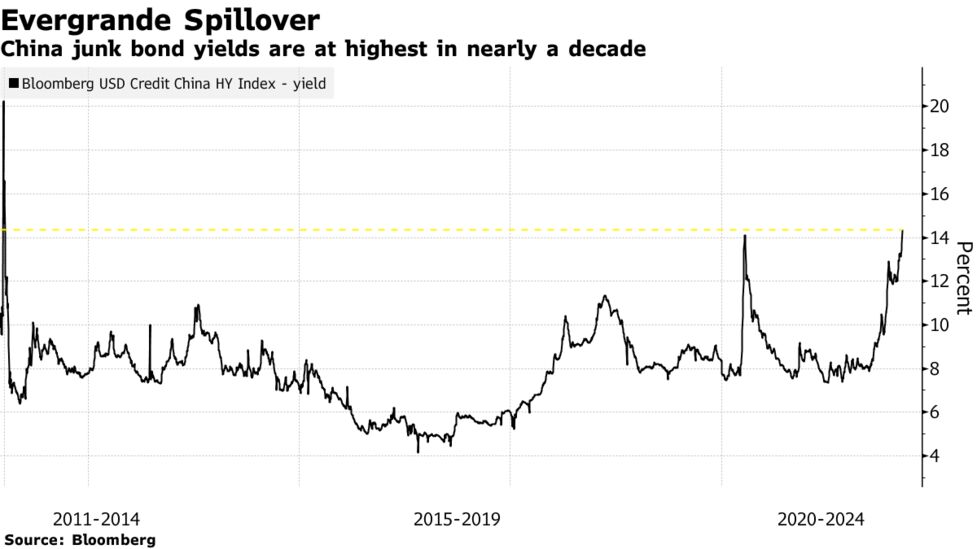

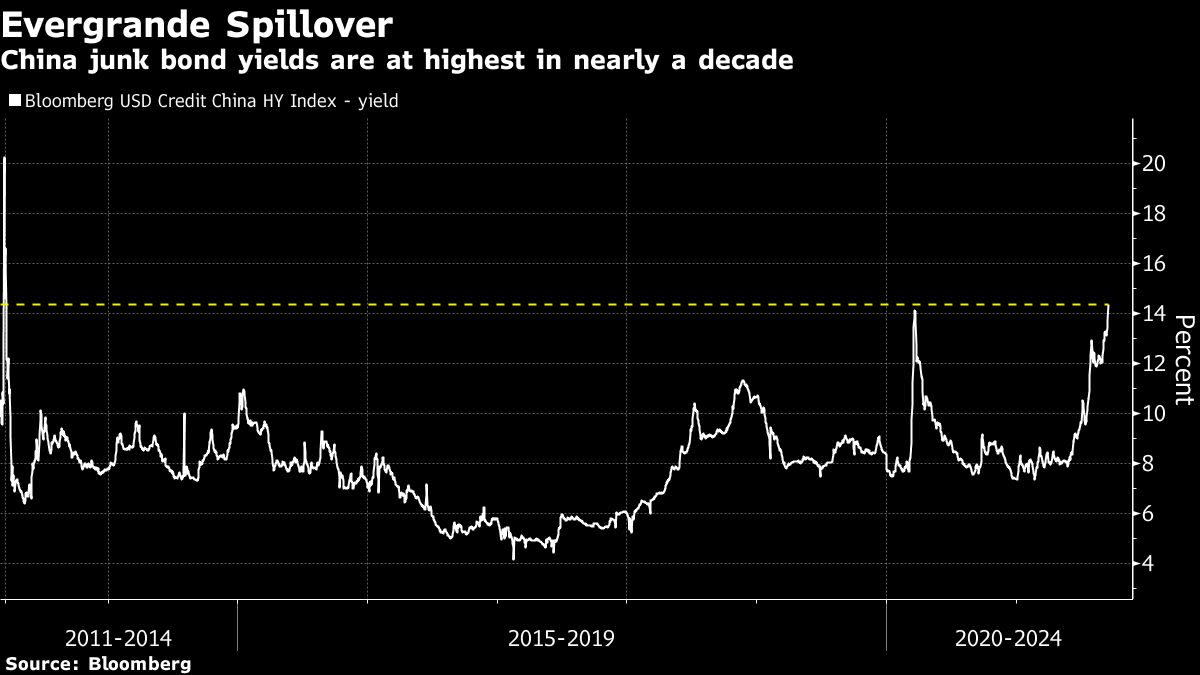

Treasury debt he added. Other analysts believe Evergrande is already causing havoc in the international markets with Bloombergs Tracy Alloway noting that yields on junk-rated debt have spiked to their highest level since March 2020. By Alexandra Stevenson and Cao Li.

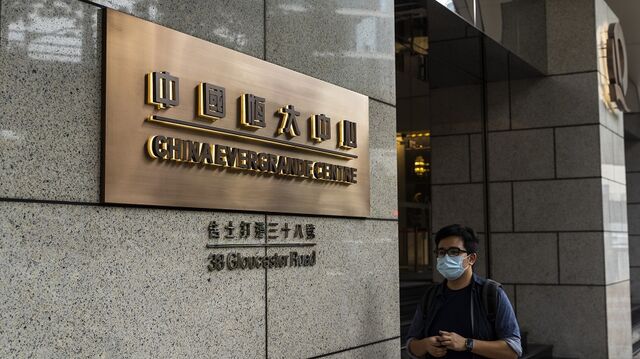

Property giant China Evergrande Group has said that it cannot sell properties and other assets fast enough to. Shares in the embattled Chinese property company Evergrande have plunged 17 as investors weigh up whether the groups massive debt problems could. The real estate developer Evergrande once binged on debt.

Evergrande 6666 221 is nursing more than 300 billion in debt and holders of Evergrandes approximately 19 billion in dollar-denominated bonds are. Become Debt Free with UK Debt Legislation. Chinas second largest Real Estate company Evergrande is over 305B in debt.

Meeting the debt reduction target for this year will put Evergrande within striking distance of. Questions loom about a government bailout and whether Evergrande is in fact too big to fail. Does Evergrandes 300B debt crisis pose systemic risk to the crypto industry.

July audits of Circle the issuer of USD coins USDC found that 9 of the companys assets were held in commercial paper at the time. Evergrande is Chinas second-biggest property developer and has huge debts with around 300 billion of liabilities to banks and bondholders. Is nursing more than 300 billion in debt and holders of Evergrandes approximately 19 billion in dollar-denominated bonds are left to wonder what will become of their investments while Wall Street attempts to gauge the potential spillover effects a collapse could have on Chinas property sector and global financial markets.

Is nursing more than 300 billion in debt and holders of Evergrandes approximately 19 billion in dollar-denominated bonds are left to wonder what will become of their investments while Wall Street attempts to gauge the potential spillover effects a collapse could have on Chinas property sector and global financial markets. USDC to Consolidate Cash and US Treasury Bills Reserves William Fong a senior trader at Australian crypto investment firm Zerocap predicts that the Evergrande debt crisis will lead to default and government intervention suggesting that the global. First published on Mon 13 Sep 2021 2324 EDT.

Meanwhile bondholders will likely lose 75 percent of their investment. As the company struggles to repay creditors Global markets have responded with selloffs. Foreign holders of Evergrandes dollar-denominated bonds which total around 20bn wouldnt have much say in what happened and would therefore face a wipeout analysts say.

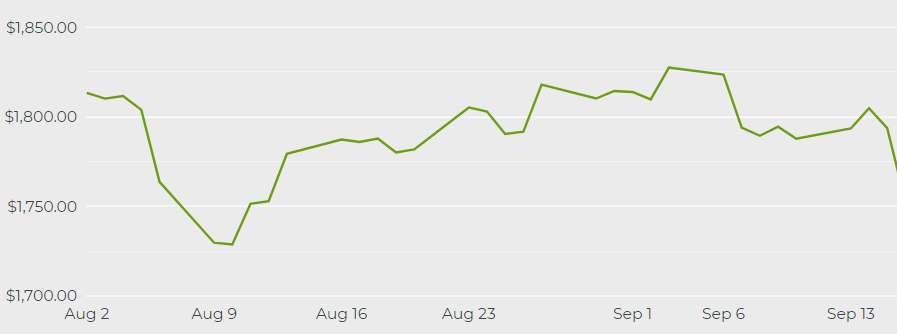

However investors could also shift funding into safe-haven assets such as US. Now the music has stopped investors are panicking and experts are warning of an imminent failure. Evergrande 6666-1130 is nursing more than 300 billion in debt and holders of Evergrandes approximately 19 billion in dollar-denominated bonds are left to wonder what will become of their investments while Wall Street attempts to gauge the potential spillover effects a collapse could have on Chinas property sector and global financial markets.

The Debt Collection Receivables Management Tracing Experts - Contact STA Today. Ad Contact The Professional Team At STA For Cost-Effective Debt Collection. Evergrandes gearing which is measured by dividing the total debt by shareholders equity stood at 199 in 2019 and is estimated to have dropped to 170 at the end of 2020.

Clock Ticks For Evergrande As 7 4 Billion Of Bonds Due 2022

As Evergrande Trims Offshore Debt And Rebuilds Investor Confidence Smes And Banks Are Overlooked In Payment Queue South China Morning Post

Evergrande How China Evergrande S Debt Troubles Pose A Systemic Risk Real Estate News Et Realestate

Ashmore Among Top Funds With Exposure To China S Evergrande Bloomberg